There are certain instances where directors may be personally liable for company debts. One of these is by way of a Director Penalty Notice issued by the Australian Taxation Office (ATO).

Director Penalty Notices can be issued to make directors liable for PAYG Tax, GST and superannuation. There are 2 types of Director Penalty Notices that the ATO can issue:

- 21-Day Director Penalty Notices – issued to directors of companies which have reported their PAYG Tax and GST liabilities, and lodged their SGC Statements within the required timeframe; and

- Lockdown Director Penalty Notices – issued to directors of companies which have reported their PAYG Tax and GST liabilities, or lodged their SGC Statements out of time, or did not report or lodge at all.

Unpaid superannuation

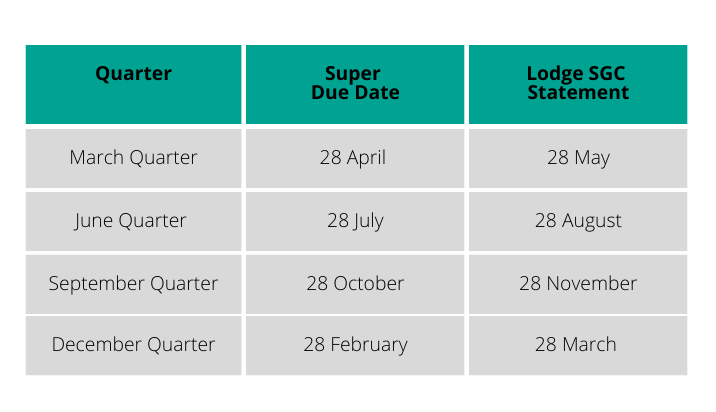

This article focuses on when you can get a lockdown Director Penalty Notice if you do not pay superannuation. If you don’t pay superannuation within timeframes due, superannuation becomes payable to the ATO as Superannuation Guarantee Charges (SGC). Superannuation is due for payment as follows:

A business which does not pay superannuation on time and therefore has to pay SGC is required to lodge SGC Statements within 1 month of the due date for payment of any unpaid employee superannuation.

There are 3 ways for a company to lodge their SGC Statements, being:

- via the ATO online services;

- by completing a spreadsheet and submitting it to the ATO; or

- by a company’s accountant via their tax agent’s portal.

Effects of Director Penalty Notices

If a company lodges SGC Statements within the above time periods, then a director can only get a 21-Day Director Penalty Notice for unpaid SGC. In that case, the director can avoid personal liability by placing their company under liquidation within 21 days from the date the ATO issued the Director Penalty Notice.

However, if you don’t pay superannuation and you don’t lodge SGC Statements within the above time periods you will get a Lockdown Director Penalty Notice.

If you get a Lockdown Director Penalty Notice, placing the company in liquidation will not relieve you from personal liability. The ATO can also issue Lockdown Director Penalty Notices after a company has been placed in liquidation.

Therefore, if your company does not pay superannuation and you don’t lodge SGC Statements within the timeframes above you will automatically be liable for unpaid superannuation and there is nothing you can do about it other than cause the superannuation to be paid.

Case study: Labour hire business

We have previously provided an example of how one of our clients was made personally liable for the company’s unpaid superannuation. This is another example:

We were recently introduced to a client which traded a labour hire business. The company had racked up more than $100,000 worth of unpaid superannuation. It was accumulated over a period of 9 months and no SGC Statements were lodged.

The company was ultimately placed in liquidation as it was insolvent. As no SGC Statements were lodged, the directors were automatically liable for the company’s unpaid SGC. Placing the company in liquidation did not avoid their personal liability.

What should have been done

When the business was not able to pay for employee superannuation, the director should have lodged the relevant SGC Statements. That way, we might have been able to negotiate a payment arrangement with the ATO.

If the company ultimately failed and/or the ATO issued a Director Penalty Notice, the company could be placed under liquidation and the directors would not have been personally liable for the company’s superannuation debts.

Contact us for assistance

As a director, ensure that SGC Statements are lodged within the required time. This might be the key to avoiding bankruptcy in the future. If you have a business partner that usually manages the company’s financial affairs and reporting obligations, it is not a defence to claim that you are unaware of the company’s failure to comply.

It is beneficial for a director to be proactive in complying with ATO obligations. If your company is struggling to keep up with superannuation payments, speak to us today to see what you can do.