Tax debts owed by Australian businesses and individuals has been slowly increasing since the end of the Global Financial Crisis.

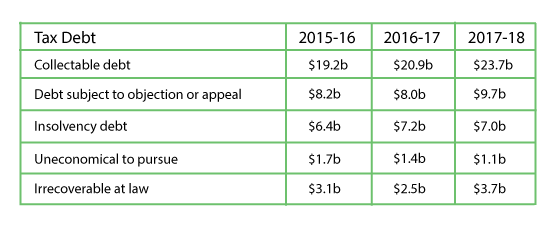

The ATO’s figures show that collectable tax debt has now reached $23.7 billion, up from $19.2 billion in the 2016 financial year. The majority of this debt is owed by small businesses.

There is also a further $9.7 billion in tax debt which is subject to objection or appeal and a further total of $8.1 billion in tax which is owed by insolvent taxpayers or which the ATO determines is uneconomical to pursue.

The tax debt figures provided by the ATO are as follows:

Tax debt owed to ATO

The ATO’s figures also show that the number of taxpayers entering into payment arrangements because they cannot pay their tax debts has been slowly increasing. In the 2015 financial year, there were 750,000 payment arrangements entered into but this has now increased to nearly 1,000,000 arrangements.

There has also been an overall increase in the number of Garnishee Notices and Director Penalty Notices issued by the ATO. The most recent figures from the ATO show that in the 2018 financial year the ATO issued the following notices:

- 51,072 Garnishee Notices; and

- 21,595 Director Penalty Notices.

Contact us for assistance

If you or your business are having difficulties paying your tax debts, the professionals at TAX DEBT SOLVED can help with a free, no-obligation consultation, contact us here.