The ATO has taken virtually no recovery action to collect tax debts since the start of the Covid-19 pandemic. However, they are now beginning to engage with businesses to collect tax debts and will take future recovery action as necessary. This will be a soft engagement at first.

ATO Commissioner Jeremy Hirschhorn has recently said that while the ATO will now be taking steps to collect tax debts, it will seek to engage with businesses to enter into payment arrangements at the first instance. He has said:

“We want people to re-engage. It’s a relatively soft engagement. We get that it’s really hard to go from nothing to full payment. We are expecting a lot of payment plans to really try to get businesses gradually back fully into the system. But what we don’t want to do is to support companies or businesses all the way through a pandemic and then by dialling debt collection up too quickly, we destroy the very thing that we’ve been trying to support.”

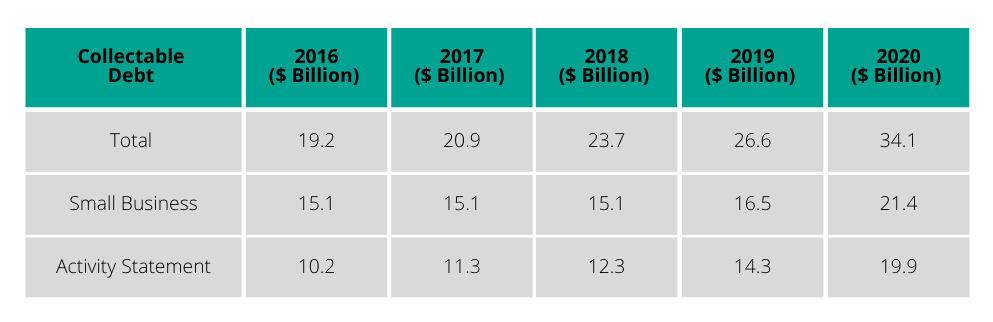

However, there will be lots of businesses out there which simply can’t pay their tax debts as the total tax owed to the ATO has significantly increased since the start of the Covid-19 pandemic. It is believed that the total collectable tax owed to the ATO has reached around $50 billion at 31 December 2020 with official figures to 30 June 2020 being as follows:

For businesses which simply can’t pay their tax debts even over time, there is often no point in entering into a payment arrangement. Doing this is just kicking the can down the road and can make things worth for a company and its directors.

What business owners should be doing if they can’t reasonably pay tax debts, is looking at other solutions. This could include things like voluntary administration, new small business restructuring, or exiting a business with as little as possible impact on its directors.

There is no better time than now to look at options available, as the ATO are generally supportive of companies which seek to take advantage of insolvency laws to compromise their debts.

Contact us for Assistance

So, if your company is having difficulty paying its debts, then you should urgently get professional advice. And TAX DEBT SOLVED can help. So, in these circumstances please contact us for a free, no-obligation consultation, contact us here.