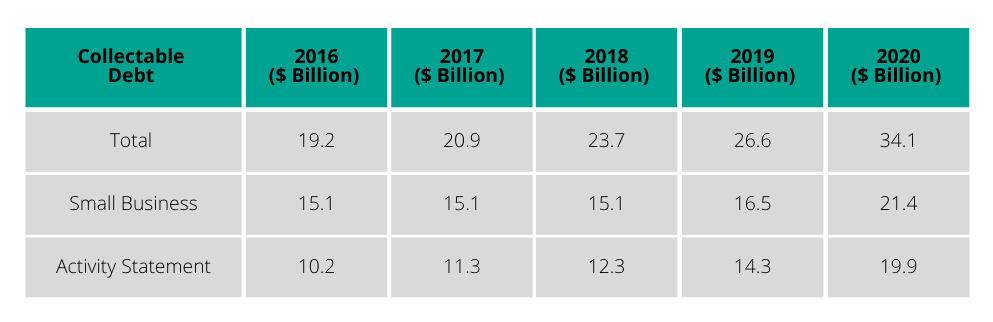

There has been a significant increase in tax debt owed to the ATO due to Covid-19. The following table below sets out what the ATO believes is total collectable tax debt:

It is believed that the total collectable tax owed to the ATO will reach around $50 billion at 31 December 2021 being nearly twice what it was in June 2019.

The major reasons for business tax debts increasing are:

- Businesses have not been able to pay tax due to financial problems; and

- The ATO essentially ceasing recovery action against businesses since the start of the Covid-19 pandemic.

The ATO not taking recovery action has allowed businesses to continue trading in circumstances where they would otherwise have to consider options available, including possibly liquidation. This is because ATO recovery action is often a driver of businesses entering into some form of insolvency appointing as they realise they cannot pay debts which they owe.

What are the future risks for businesses

The ATO has slowly started to take a firmer line with businesses. At this stage we have seen this mainly through the ATO contacting businesses and requesting payment or a payment arrangement. However, the ATO will soon start taking recovery action against businesses again such as issuing Director Penalty Notices or Garnishee Notices. Business owners will then need to decide whether they can pay the ATO or whether they should look at other options available including:

The main risk for directors of companies with ATO debt is through the ATO issuing Director Penalty Notices. These notices make a director liable for a company’s PAYG Tax, GST and superannuation debts. They can therefore cause major problems for directors who receive them. And this could include lots of company directors, given there was nearly $20 billion in PAYG Tax and GST owed at 30 June 2020.

What should business owners do

If your company has a tax debt you should urgently seek advice about how to deal with it and risks involved. We will discuss these issues with you for no upfront cost and provide information on the options available.

So, if you wish to obtain advice or assistance, please contact us. Our experienced staff will be able to assist you.