What are the requirements to pay superannuation?

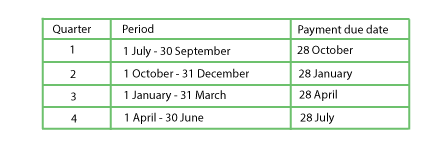

You must pay superannuation to your employees’ superannuation funds at 9.5% of their ordinary time earnings. Generally, superannuation is payable by the following dates:

If superannuation is due on a weekend or public holiday, you can make a payment on the next working day.

Consequences of not paying superannuation

Superannuation Guarantee Charge is payable

When you don’t pay superannuation on time you must pay it to the ATO as Superannuation Guarantee Charge (SGC). This charge includes:

- The initial superannuation payable;

- Interest, which is currently 10%; and

- An administration fee of $20 per employee, per quarter.

As part of paying the superannuation to the ATO you must also lodge a Superannuation Guarantee Charge Statement. You are required to lodge this statement on the date superannuation is due for payment.

SGC is not tax deductible

If you don’t pay superannuation and therefore have to pay SGC then the superannuation payment is not tax deductible. This means that you will also have more income tax to pay.

Director Penalty Notice liability

If you trade a business through a company and you don’t pay superannuation the ATO can issue you with a Director Penalty Notice. There are two types of Director Penalty Notices for superannuation.

The first type applies where superannuation is not paid but Superannuation Guarantee Charge Statement(s) are lodged within one month of the superannuation being due for payment. In these circumstances the ATO can issue you with a director penalty notice to you, however, you can avoid liability under the notice if:

- The SGC is paid; or

- The company is placed in liquidation or voluntary administration within 21 days of the date of the Director Penalty Notice.

The second type of Director Penalty Notice is referred to as a Lockdown Director Penalty Notice. It applies where a company fails to pay superannuation and it also fails to lodge SGC statements within one month of superannuation being due for payment. If this happens:

- The ATO can and will Issue you with a Director Penalty Notice to recover superannuation;

- The ATO can estimate unpaid superannuation if it needs to;

- Placing the company in liquidation or voluntary administration will not avoid liability; and

- The ATO can issue you with a Director Penalty Notices after the company has gone into liquidation.

Other penalties apply

The ATO can also fine you for not paying superannuation. In serious cases the ATO can also prosecute people for not paying superannuation which may result in imprisonment.

Contact us for assistance

If you or your business are having difficulties paying employee superannuation or other tax debts, the professionals at TAX DEBT SOLVED can help with a free, no-obligation consultation, contact us here.